Posted by Jon Klein of The Topline Strategy Group on Thursday, Feb. 25, 2010 @ 10:45AM

By Jon Klein

Though only 177 of the total 258 Olympic medals have been awarded so far, with Germany and the United States still battling for medal supremacy (as of February 23, the US had 26 medals and Germany 23), the real winner of the 2010 games has already been decided : American entrepreneurism.

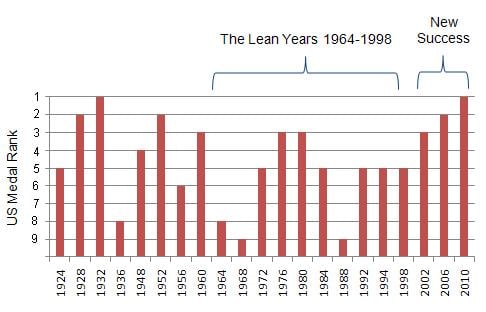

From 1964 until 2002, the United States' performance in the Winter Games could only be described as dismal. During that period, the US ranked no higher than 3rd and as low as 9th in the medal count and only earned between 5% and 10% of all medals awarded.

US Winter Olympic Performance Lagged from 1964 to 1998, but Has Improved Dramatically Since

However, US fortunes started to change in 2002, when the country ranked 3rd in the medal count and won an impressive 14.5% of the medals awarded. In 2006, the US rose to 2nd in the medal count and as of February 23rd, US performance at the 2010 Games has hit its highest water mark since 1952, ranking 1st in the medal count and winning 14.7% of the medals.

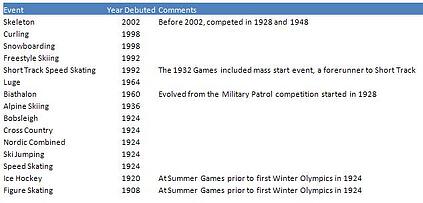

So what happened to transform the US from Winter Olympics straggler to the champion of the games? If you think the reason is that a group of premiere Luge academies and Biathalon camps were established in the US to improve our training, guess again. The answer is that over the last 20 years, the US has innovated its way to the top of the medal count. Of the 15 Olympic sports contested in Vancouver, one-third of them made their Olympic debut during or after the 1992 games: Snowboarding, Freestyle Skiing, Short Track Speed Skating, Skeleton, and Curling. The three of them that award the most medals (Snowboarding, Freestyle and Short Track) were primarily invented in the US and the US remains the unquestioned leader in these events.

2010 Winter Olympic Sports by the Year They Debuted in the Olympics

Notes: Despite Skeleton's presence in 1928 and 1948, the more relevant year for this analysis is 2002, the date it returned to competition. Mass Start Speed Skating, the forerunner to today's Short Track, was the popular form of the sport in the US and included in the 1932 Lake Placid games.

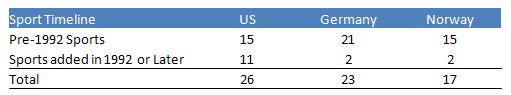

The impact of these events on US performance cannot be overstated. Of the 2010 medals awarded in these sports, the US has won an astounding 25% of the total. Without them, instead of ranking 1st in the medal standings, the US would be tied for 2nd with Norway, 6 medals behind Germany.

Performance of the Top 3 Medal Winners by Date the Sport Debuted in the Olympics

So what does this all mean? First, it means that we get to mingle great entertainment with national pride. For me, the highlight of the Games has been Shaun White winning the Half Pipe with a performance head and shoulders above everyone else. Second, and more importantly, it is a reminder that the strength of our country comes from our entrepreneurial spirit. These sports were invented in the US and through the hard work and dedication of the sports' innovators, generated a worldwide following that ultimately led to their inclusion in the Olympic games.

___________________________________________

Jon is the founder and general partner of The Topline Strategy Group, a strategy consulting and market research firm specializing in emerging technologies. Jon brings a unique blend of strategy consulting and hands on operating experience to The Topline Strategy Group and works closely with Semaphore on a variety of engagements.