Posted by Jon Klein of The Topline Strategy Group on Thursday, June 17, 2010 @ 10:00AM

Blog Series 3 of 4

Pipeline Interviews: The Missing Piece

At this point, you may be thinking, "The analysis addressed the overall market size, the potential penetration of the market, and the company's likely share. Shouldn't that be enough?" Actually, it isn't. The typical due diligence process is based on the critical assumption that the accounts that have purchased a solution from the company or its competitors are fundamentally the same as accounts that have not yet purchased. Given enough time, the non-buyers will eventually buy a solution if it has a strong value proposition.

But what if that assumption is wrong? What if the accounts who haven't bought are somehow fundamentally different than the ones that already have purchased in a way that isn't obvious from segmentation factors like size or industry? If that is the case, then ‘I haven't purchased yet' becomes ‘I'm never going to purchase' and the market is far smaller than calculated. And, if the market is smaller than you calculated, the company may never reach its revenue projections.

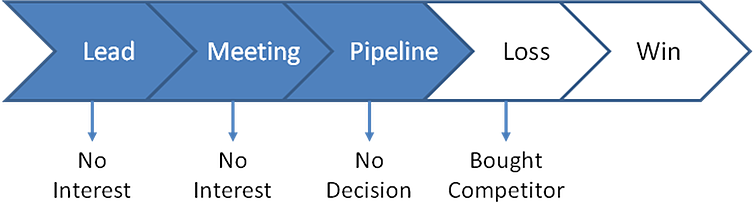

Pipeline Interviews: Interviews with Accounts that Fell Out of the Pipeline without Making any Purchase

So how do you sort out whether or not you have an ‘I'm never going to purchase' problem? The answer is through Pipeline Interviews. Only prospects that have had sales interaction with the company but decided not to purchase anything can answer this question. They know whether their decision not to buy is primarily a timing issue or is due to something more fundamental.

Continuing with the CRM for Law Firms example, it turns out that approximately 30% of law firms with over 100 people have a fundamentally different selling model than one that is supported by a CRM. Examples include firms who primarily serve consumers and those that focus on a very narrow subspecialty and act as a subcontractor to general practices. These types of firms will never buy a CRM system since it doesn't fit their business.

In this case, the market turns out to be about 70% as large as calculated using traditional methods. We have conducted numerous due diligence projects over the years where the market turned out to be a fraction of the size originally believed, including:

- A company providing translation management software where the real market turned out to be only 10% of the original target: $1B+ companies with 25% or more of their sales overseas. Many industries, such as aviation, do business solely in English everywhere, regardless of local language and do not need translation. Others, such as packaged goods companies, develop custom materials in each market and do not need translation either.

- A company providing software simulations for training repair technicians on maintaining products found that the real market was only 25% of the original target: $500M+ companies that provide low and medium tech equipment such as lawn mowers, pumps, and oil field equipment. Because the process of repairing each product is unique, a separate simulation is required for each product. For the cost of a simulation to outweigh its benefits, the product either has to have very large sales (over $100M/year) or a very long lifecycle (10+ years). The Pipeline Interviews revealed that most companies did not have a single product with sufficient sales (they had a wide range of smaller products) or a long enough lifecycle to make a simulation economical.

_______________________________________________________

This article was contributed by Jon Klein. Jon is the founder and general partner of The Topline Strategy Group, a strategy consulting and market research firm specializing in emerging technologies. Jon brings a unique blend of strategy consulting and hands on operating experience to The Topline Strategy Group and works closely with Semaphore on a variety of engagements.

To read the full White Paper, please go to Semaphore News and click on the May 3, 2010 link titled - White Paper - Market Due Diligence